INDEX OF THE QUALITY VALUE WEEKLY INVESTMENT NEWSLETTER

1️⃣ The Weekly Investment Idea

This week we’re sharing 2 instead of 1 ;)

2️⃣ 5 Weekly Charts

3️⃣ Investment Tools Recommendation

4️⃣ The Educational Pill of the Week

5️⃣ 2 Weekly Videos

1️⃣ The Weekly Investment Idea

This week I’d like to highlight two UK companies:

Elixirr International (ELIX) – A multibagger we shared with the community three years ago, being the first in the Spanish-speaking world to publish a thesis on the company. Since then, it has generated significant gains for many subscribers. This week, it stood out again with outstanding results and the announcement of its largest acquisition to date—a move that could act as a catalyst for the stock to keep multiplying in value in the coming years.

JTC plc (JTC.L) – A special arbitrage situation that could offer very attractive short-term returns with controlled risk.

Two British companies, two very different opportunities:

Elixirr: a long-term compounder with transformational acquisitions.

JTC: a special arbitrage play where timing and probability are key.

1. Elixirr International (ELIX)

Elixirr is a London-based business consultancy, comparable to global firms such as Accenture, though on a smaller scale. I brought it to the community in June 2022, and since then, the company has been executing our thesis with remarkable precision.

You can revisit the 2022 thesis here.

Since its IPO in 2020 at £2 per share, the stock has multiplied 4x in just five years.

👉 A perfect example of how, over the long term, price follows earnings.

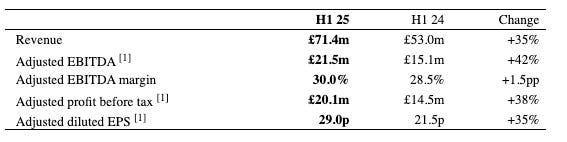

Strong results and largest acquisition to date:

Delivered excellent results.

Announced the largest acquisition in its history, acquiring a high-quality business at attractive multiples.

2. JTC plc (JTC.L)

JTC provides professional services in the financial sector across three areas:

Fund administration (accounting, compliance, transparency).

Corporate services (company incorporation, accounting, reporting, legal compliance).

Private client services (trust structuring, property management, succession planning).

What’s happening?

The company is currently at the center of strong private equity interest:

Permira has until September 26, 2025 to decide whether to launch a takeover bid.

Warburg Pincus has until October 10, 2025.

Even Advent has explored the deal, adding competition.

Before the rumors, shares traded at 950–1,000p. After the news, they surged past 1,300p, reflecting that the market already expects a takeover premium.

Possible scenarios:

Confirmed and competitive bid → further premium if a bidding war unfolds.

Lower-than-expected offer → potential “sell the news” correction.

No bid → shares could fall back to 950–1,000p.

Investor takeaway:

This is an event-driven arbitrage play with short-term return potential but no guarantees. The market already prices in part of the premium, though there is still upside if an attractive bid materializes.

Key dates to watch:

September 26 and October 10 – decisive deadlines.

Any official RNS announcement confirming or rejecting an offer.

Poll:

Do you like these short-term ideas in the newsletter?

Yes, a lot → 84%

Yes, it’s fine → 16%

Not convinced → 0%

(19 votes · 5 days left)

2️⃣ 5 Weekly Charts

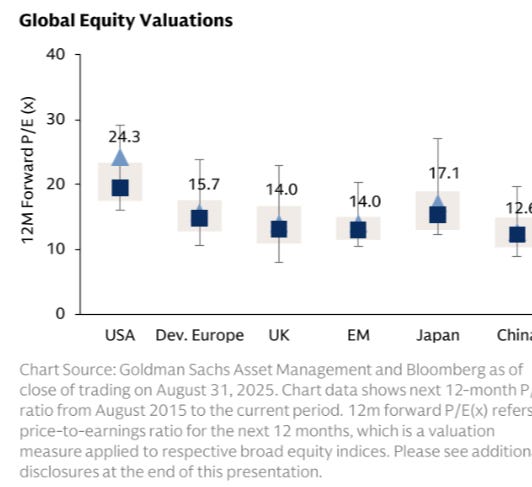

Forward P/E ratios by region: U.S. is the most expensive (24.3x) and China the cheapest (12.4x), with Europe, UK, EM, and Japan in between.

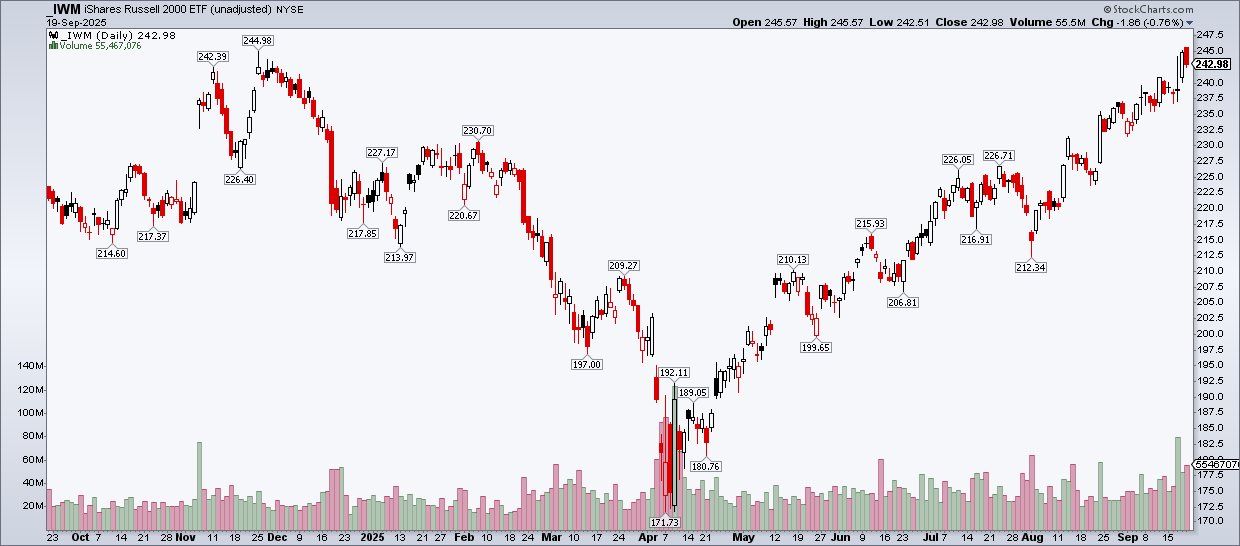

Russell 2000 (IWM) rebounded sharply from the April 2025 low of 171.7 to close at 242.9 in September, near yearly highs. The nearly +40% rally reflects renewed interest in U.S. small caps.

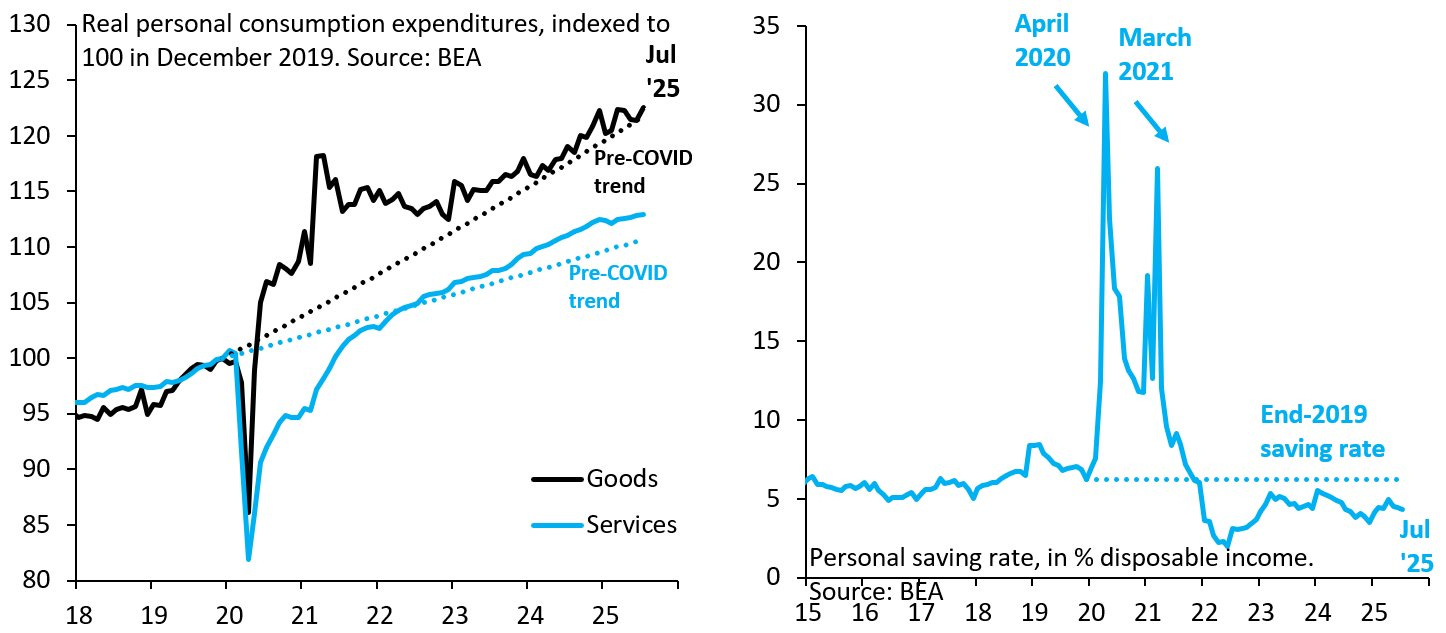

In the U.S., goods consumption remains above the pre-COVID trend, while services lag behind. At the same time, personal savings rates dropped after the 2020–21 peaks and are now below 2019 levels.

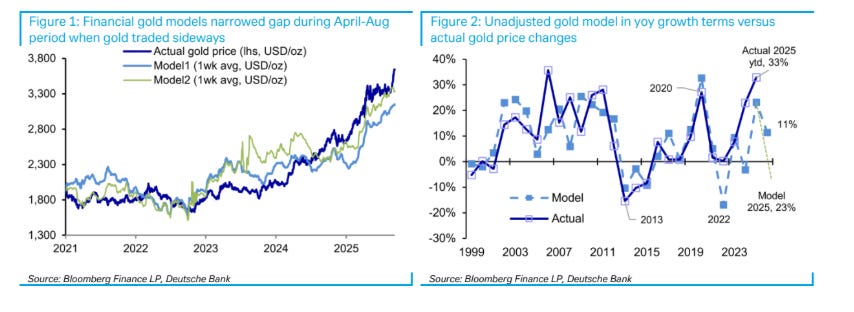

Gold surged in 2025, breaking above $3,300/oz and gaining +33% YoY—well above model forecasts (+23%). Financial indicators confirm a stronger-than-expected bull cycle.

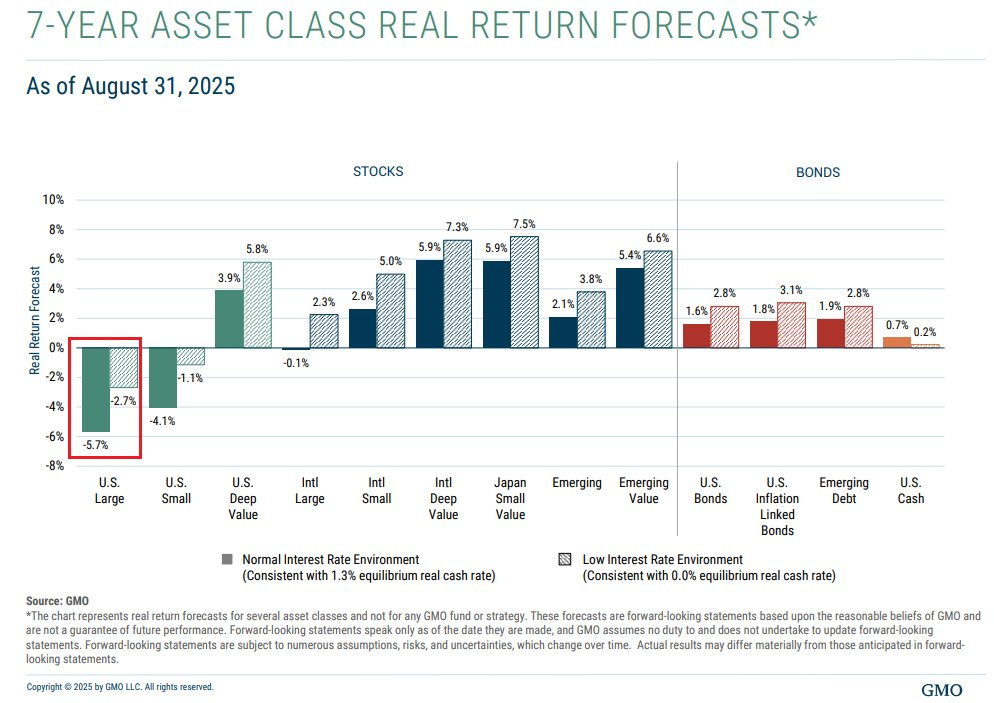

According to GMO, the next 7 years point to negative returns in U.S. large caps, while the biggest potential lies in international value, Japanese small caps, and emerging markets (5%–7.5% annually). Bonds are expected to deliver modest returns around 1%–3%.

3️⃣ Investment Tools Recommendation

This week, rather than a tool, I want to recommend a free event that I’ll personally attend: Rankia Markets Experience.

Each edition gathers 1,500+ investors, traders, and savers for a full day designed for those seeking a deeper understanding of the economy and new investment ideas.

The event is structured into three themed rooms:

Buffett → Macroeconomics, personal finance, and market trends.

Kostolany → Technical trading and operational strategies.

Forum → Best investment theses in funds.

Speakers include notable figures like Francisco García Paramés, Pablo Gil, and Álvaro D. María, who will share their market insights and practical strategies.

👉 You can register for free here.

4️⃣ The Educational Pill of the Week

What is “momentum” and how does it relate to Quality Value?

Momentum is based on a simple idea: stocks that have gone up tend to keep rising for a while, while those that have fallen often keep falling. This happens because markets don’t react instantly—trends build as investors digest information.

My Quality Value philosophy focuses on buying high-quality companies at attractive prices, with patience as the key ingredient. Still, momentum can add another layer: it shows us when the market starts to recognize that value and when catalysts kick in (e.g., earnings improvement, transformative acquisition, regulatory change).

Put simply: Quality Value gives us the “what” (excellent companies at attractive multiples), and momentum helps with the “when” (the timing of catalysts being reflected in share prices).

💬 Share your thoughts on this reflection.

5️⃣ The 2 Weekly Videos

📹 Ray Dalio is Warning You…(Most Won’t Listen)

📹 Ray Dalio with David Rubenstein: How Countries Go Broke

✅ Want to improve as an investor and discover exclusive opportunities?

Become a subscriber for €12.49/month and get access to:

A full database of all published investment theses (60+).

Access to new theses published weekly: at least 2 investment opportunities per month.